Case Studies

Overview

Prestige Capital is a commercial finance company that specializes in factoring for Early Stage and Mid-Sized companies. Prestige purchases invoices from a broad range of businesses with annual sales ranging from $1 million to $250 million.

Overview

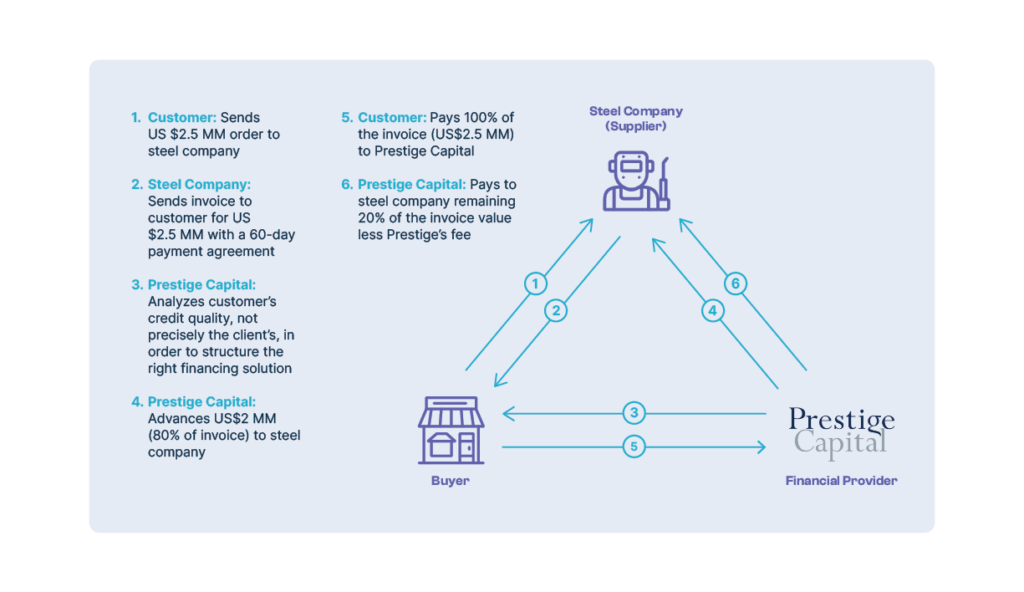

A steel company with projected sales of $10M with historically cash-on-delivery terms with customers, is suddenly forced to offer net 60-day terms to retain key customer accounts. One of the steel company’s customers places an order of $2.5M — after which the steel company delivers the product and sends the corresponding invoice. However, the steel company needs the cash flow now to support the daily operating expenses and inputs for the steel production to fulfill the customer order.

Prestige Capital, as a factoring services provider, analyzes the customer’s credit quality, not the steel company’s, in order to structure the right financing solution. Prestige Capital advances $2M (80% of the order) to the steel company in order to finance the operating expenses and inputs for production. Once the customer pays 100% of the invoice to Prestige Capital, not to the steel company, Prestige Capital sends to the steel company the remaining 20% of the invoice value less Prestige Capital’s fee (1.5%, but this varies based on the deal size and invoice days outstanding) of the total invoice value. As a result, the liquidity that Prestige Capital provided to the steel company empowered it, by enabling it to leverage an opportunity for growth.