Case Studies

Overview

Based in Cape Town, South Africa, Finvex.tech is a business-to-business (B2B) provider of technology and finance solutions related to working capital for businesses.

Overview

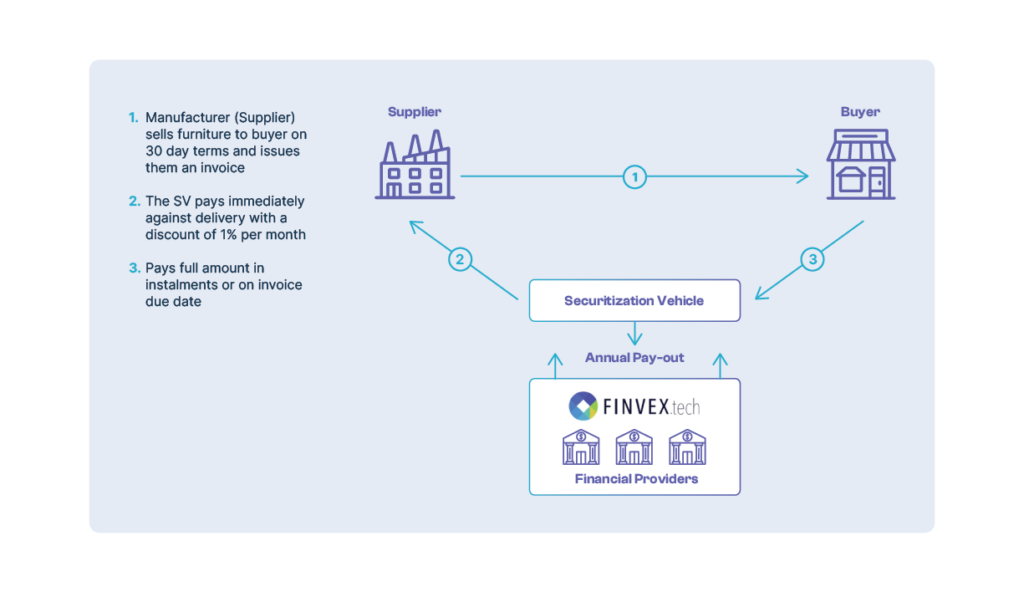

A furniture manufacturer is looking to expand its sales to its largest clients (big-box stores). In order to do this, it offers its clients better payment terms of 30 days. The furniture manufacturer would traditionally need to fill this gap with shareholder capital or bank debt. To deal with this, the manufacturer gets in touch with Finvex.tech, a company that provides a tech- integrated impact financing solution to help companies improve their working capital and strengthen their supply chain.

Finvex.tech’s solution can create its own receivables financing and attract financiers into a joint finance structure. A joint program with the manufacturer and Finvex.tech’s Securitization Vehicle is created. This is a mezzanine structure with equity and a senior tranche. With this program, the manufacturer sends an invoice to its client with a 30-day payment term. The joint financial structure purchases these receivables from the manufacturer and charges a 1% rate per month. The big-box store can then pay directly into the finance structure. After this, the securitization vehicle can then provide external financiers with a return of 7% due to the strong credit ratings of the big-box stores.