Foundations are starting to become more interested in the innovative capital space and can be a great source of risk-tolerant funding, but it’s important to understand the various types of funding that most foundations use.

Downloads

Key Elements

- Three major funding strategies: grants, PRIs, and MRIs

- Philanthropic funding tied to a charitable purpose

- Funders can have a higher risk tolerance than institutional capital

How do philanthropic foundations contribute to fund managers?

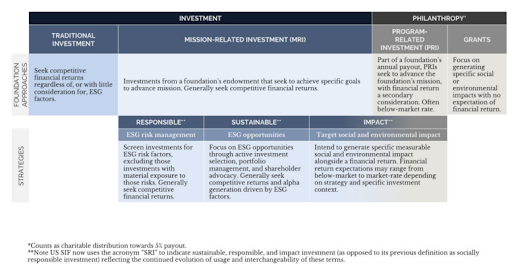

Foundations have three major funding tools for fund managers across the capital spectrum:

Grants are a financial donation given to an organization. Foundations primarily award the majority of their grants to 501(c)(3) organizations and other tax-exempt organizations. Grants are donations, not investments, and need to meet a specific charitable standard to qualify as a grant. Generally, foundations must follow the “5% payout requirement” and distribute annually—through grants and grant-related expenses—at least 5% of the total market value of net investment assets from the preceding year to avoid paying taxes. This rule forces foundations to distribute money for charitable purposes instead of fully leveraging the tax-exempt status as a tax shelter for wealth generation.

PRIs are mission-driven investments closely related to charitable grants. Unlike MRIs, an investment is required to meet a specific charitable standard to qualify as a PRI. However, a PRI does not need to be a market-rate or “prudent” investment. PRI strategies are still an innovative funding tool used by a small number of foundations. Traditional grantmaking strategies only use grants and avoid PRIs due to the risk-averse nature of foundations, which are hyper-focused on charitability. PRIs create an extra layer of regulatory and underwriting complexity for foundations. Thus, it is easier for a foundation to make a grant to a nonprofit than a fund manager.

MRIs, also commonly referred to as “impact investments,” further an organization’s mission. Any investment in which the investor intends to generate both a social return and a financial return, such that it is not exclusively about profit, could qualify. There is no legal definition of an MRI and no legal requirements to qualify for, or prohibitions resulting from, this status. An MRI is not a charitable activity. MRIs are made from investment assets rather than program assets, sometimes referred to as the endowment side or the “other 95%” of a foundation’s assets that are not designated for making charitable qualifying distributions. MRIs do not need to meet the charitable standards that a PRI must meet.

Source: Rockefeller Foundation

Grants

A quick guide for fund managers to approaching foundations for grant funding.

Research & Background Check

Check the foundation’s website for grant opportunities or Request for Proposals (RFPs) to see if your fund may be a fit for funding. Additionally, most foundations have a public list of their historical grantees and grant amounts available on their website which is worth reviewing. If they don’t list the grantees on their website, then check out a more detailed list available in their 990 forms via Candid, GuideStar, IRS, and ProPublica. The 5% payout requirement can help you estimate how much a foundation needs to make in grants annually by knowing its total assets (multiply Total Assets by 5% to get an estimate for their annual grant budget).

Intro Call

If there is a potential fit, connect with the foundation’s program or grantmaking team to ask any RFP-related questions.

- Are you considering fund managers or private investment funds for this grant opportunity?

- If my fund is not structured as a 501(c)(3) or does not sit within a 501(c)(3), can my fund still be a fit?

- Have you ever made a grant to a fund manager?

- If yes, what is the typical grant size?

- If yes, how was the fund manager allowed to use that grant—operating capital on the management company side and/or investment capital on the LP side?

- Does my investment strategy fully align with your foundation’s charitable purpose? Which parts make you nervous for charitability?

Application

If there is a potential fit, then fill out the grant application.

Uses

Foundations rarely will make grants outside of their comfort zone of funding nonprofits, but occasionally they will use grants to support fund managers. If they do, then they typically will use grants to support operating capital needs or fund expenses—such as a staff, travel, convening, or capacity building grant—for fund managers. This is a great way for first-time fund managers to offset expensive launch costs and extend the fundraising runway.

PRIs

A quick guide for fund managers to approaching foundations for PRIs.

Research & Background Check

Check the foundation’s website for its “impact investing,” “catalytic capital,” or “innovative finance” strategy to see if your fund may be a fit for funding. Most foundations have a public list of their historical grantees and grant amounts available on their website, which is worth reviewing and filtering for PRIs. If they don’t list the grantees on their website, then check out a more detailed list available in their 990 forms via Candid, GuideStar, IRS, and ProPublica. The 5% payout requirement can help you estimate how much a foundation needs to make in grants annually by knowing its total assets (multiply Total Assets by 5% to get an estimate for their annual grant budget).

Intro Call

If there is a potential fit, connect with the foundation’s impact investing team to ask any PRI-related questions.

- Are you considering fund managers or private investment funds for your PRI strategy?

- Have you ever made a PRI to a fund manager?

- If yes, what is the typical PRI size?

- If yes, how was the fund manager allowed to use that PRI—operating capital on the management company side and/or investment capital on the LP side?

- Does my investment strategy fully align with your foundation’s charitable purpose? Which parts make you nervous for charitability?

Application

If there is a potential fit, then fill out the PRI application.

Uses

Foundations with PRI strategies are more likely to support fund managers than foundations without PRI strategies. They will make PRIs or impact investments in funds or intermediaries to advance their foundation’s philanthropic strategies and programs. Generally, PRIs have more flexibility than grants and can be used to support operating capital needs or investment capital. Fund managers need to determine the best use of PRI capital—whether they can use it on the GP or LP side.

MRIs

A quick guide for fund managers to approaching foundations for MRIs.

Research & Background Check

Check the foundation’s website for its “MRI,” “ESG,” “SRI,” or “impact investing” strategy to see if your fund may be a fit for funding. Unlike grants or PRIs, foundations do not publicly disclose their MRIs, because they are not legally required to by the IRS. Typically, you can research articles, reports, and other publications by the foundation to learn more about its MRI portfolios.

Intro Call

If there is a potential fit, connect with the foundation’s MRI or endowment team to ask any MRI-related questions.

- Have you backed any emerging fund managers in your MRI strategy?

- How do you define an “emerging” fund manager?

- Have you ever made an MRI to a fund manager with an innovative capital model like RBI, profit sharing, or employee ownership?

- What is the smallest fund size you’re willing to back as an LP?

- What is the typical MRI size?

- Does my investment strategy fully align with your foundation’s mission?

Build Relationship & Pitch

If you still believe there is a potential fit, then continue to build a long-term relationship with the foundation. If your first or second fund does not currently fit their MRI criteria, perhaps your third or future fund will be a good fit.

Uses

Foundations with MRI strategies make LP investments in fund managers and can not provide philanthropic support like they can on the grantmaking side. If you are too early for their PRI program, then most likely you are way too early for their MRI program as a fund manager. Foundations will rarely invest in first-time fund managers or innovative fund models out of their MRI program.