Case Studies

Overview

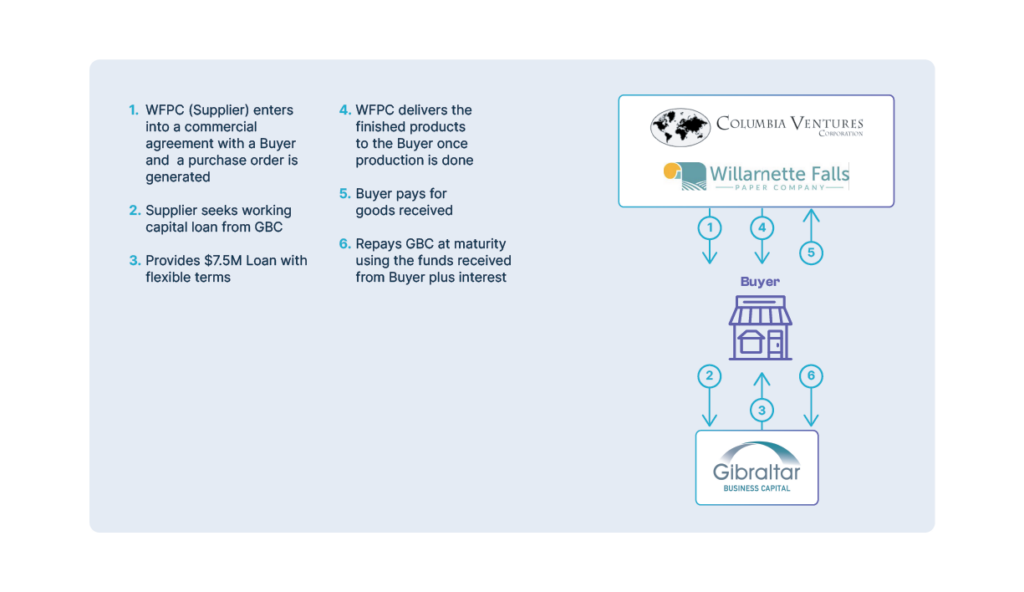

Gibraltar Business Capital provides stability during periods of transformation for small and mid-market businesses. Delivering quick access to working capital, Gibraltar partners with businesses when banks and other funding sources are limited or too restrictive.

Overview

An Oregon-based independent manufacturer that utilizes sustainable and recycled fibers to produce coated freesheet, offset, envelope, packaging, and specialty papers, was on a solid growth trajectory driven by rapid sales demand. Its core financial sponsor was the family office Columbia Ventures Corporation, but the company needed liquidity to fund its production inputs; thus it sought a lender for a $7.5M asset-based loan.

Gibraltar Business Capital provided the credit facility supported by advances against accounts receivable and inventory. Additional flexibility was provided to the company through a no-covenant structure since the company’s financial sponsor was a reputable family office. Gibraltar Business Capital turned out to be the right lender because of its borrowing base creativity and its ability to provide a loan without tying up all the company’s assets.