Case Studies

Overview

Sage Growth Capital (Sage) is a Boise-based RBI fund that provides flexible growth capital to companies throughout the United States.

Overview

Sage was founded in 2019 by Denise Dunlap, Molly Otter, and Kevin Learned. The three co-founders and partners bring private equity, revenue-based and angel investment experience along with angel group administration. Dunlap and Learned have deep angel investor networks given their work at the Angel Capital Association (ACA) and Loon Creek Capital Group. Otter brings significant experience in the revenue-based space since she served as the CIO for five years at RBF lender Lighter Capital and is currently a member of their board.

In late 2019, Sage raised $2.1 million for their first fund primarily from local angel investors. In June 2022, they closed their second fund at $7.7 million.

Investment Strategy

Sage makes revenue-based investments in early- and growth-stage companies throughout the U.S. The team seeks companies with $300K+ annual revenues, 40%+ gross margin, and 25%+ growth rates. They wanted to provide a more flexible capital product for founders who did not fit traditional funding models, and increased options for liquidity for angel investor portfolios. Sage is industry agnostic and will invest in companies that have recurring or “recurring-like” revenue streams.

Fund I invested in seven companies over its two-year investment period, with two follow-on investments. As of June 2022, Fund II has invested in four companies. Sage will invest up to 1/3 of a company’s revenue over the previous 12 months. Check sizes range from $100K to $1M with reserves for larger, follow-on investments for companies who achieve their growth projections.

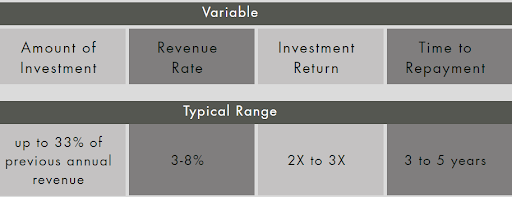

Revenue-Based Note: Sage offers a revenue-based investment product for growing businesses with the following terms.

The “Revenue Rate” is the revenue share or percentage of the company’s cash receipts (i.e. customer payments) for monthly repayment. Sage charges between 3% and 8%.

The “Investment Return” is the return cap. Sage charges between 2x and 3x based on the risk profile of the company.

Additionally, Sage offers a grace period of up to three months and does not require personal guarantees or collateral for founders.

Track Record

Sage Growth Capital Fund I (2019, $2.1M) was fully invested across seven companies as of June 2022. Portfolio companies include:

- Killer Creamery (Meridian, ID) makes keto-friendly ice cream products.

- Prosperity Organic Foods (Boise, ID) produces plant-based butter and cheese products for North America, South America, and Australia.

- Unity Laundry Systems (Bedford, NH) produces essential and affordable appliances for the commercial laundry industry.

- Refactr (Seattle, WA) is a DevSecOps software startup founded in 2017 by military veterans and industry experts in cloud and cybersecurity (paid off early).

- eTT Aviation (Boise, ID) is a software engineering company that provides airlines a fully automated and customizable air operations suite of tools (paid off early).

- CPR Construction Cleaning (Gilbert, AZ) provides construction cleanup needs in every vertical of construction.

- Native English Institute (Seattle, WA) is transforming language learning through a data-driven AI and natural language processing solution.

Sage Growth Capital Fund II (2022, $7.7M) has invested in four companies as of June 2022. Portfolio companies include:

- Unity Laundry Systems (Bedford, NH) produces essential and affordable appliances for the commercial laundry industry (follow on to Fund 1 investment).

- Naked Sports (Vashon, WA) produces a line of high performance gear for outdoors endurance runners.

- CyberReef (Shreveport, LA) SaaS mobile data bandwidth management and secure private networking software.

- Mign (Charlotte, NC) Builds personalized, digitally tailored medical wearables in the orthopedics field to enhance recovery of musculoskeletal injury.

Fund Structure & Terms

Fund I

- Management Company: Sage Growth Capital, LLC (Idaho LLC)

- Fund: Sage Growth Capital Fund I, LLC (Idaho LLC)

- Fund Type: Rule 506(b)

- GPs: Denise Dunlap, Molly Otter, and Kevin Learned

- Terms

- Fund Size: $2M

- GP Commitment: 7.5% of fund size

- Investment Period: 2 years

- Fund Life: 7 years with 3 one-year extensions

- Management Fee: 2% of distributions until 1x DPI; 0% thereafter

- Carried Interest: 10%

- Preferred Return: None

- Key Persons: Denise Dunlap, Molly Otter, and Kevin Learned

Fund II

- Management Company: Sage Growth Capital, LLC (Idaho LLC)

- Fund: Sage Growth Capital Fund II, LLC (Idaho LLC)

- Fund Type: Rule 506(b)

- GPs: Denise Dunlap, Molly Otter, and Kevin Learned

- Terms:

- Fund Size: $7.7M

- GP Commitment: 2.25% of fund size

- Investment Period: 3 years

- Fund Life: 7 years with 3 one-year extensions

- Management Fee: 2% of committed capital

- Carried Interest: 20%

- Preferred Return: none

- Key Persons: Denise Dunlap, Molly Otter, and Kevin Learned