Current Capital Access for Small Businesses

In 2022, the Federal Reserve’s Small Business Credit Survey found that 59% of small businesses experienced a financing shortfall or unmet financing needs. According to research conducted by the Kauffman Foundation, 83% of US small businesses don’t access any form of outside capital at all for their business. Clearly, our systems for financing small businesses and startup companies are not sufficiently serving the needs of American entrepreneurs.

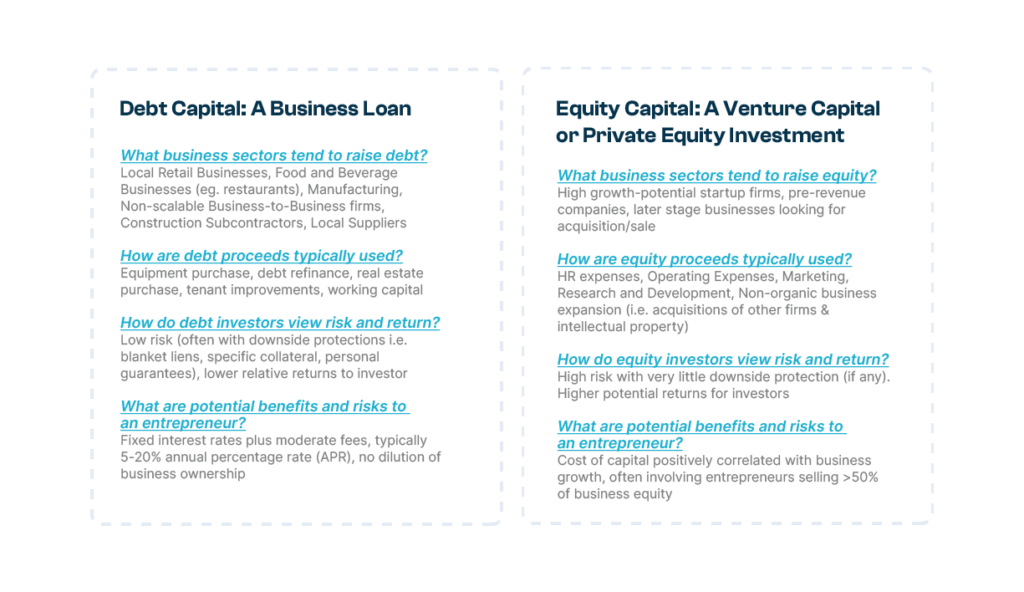

When entrepreneurs need capital for their business, they are typically confronted with a binary choice between two vastly different capital products: debt or equity.

There are two major problems with the current status quo of capital options for small businesses:

Problem #1: Debt and equity capital markets have consistently proven themselves incapable of serving all entrepreneurs equally

While the days of overt redlining are behind us, small business lending is still rife with inequities. Take, for instance, racial disparities in lending outcomes:

- Business owners of color pay average interest rates that are 22% higher than white business owners (7.8% vs. 6.4%).

- Loan denial rates for business owners of color are twice as high as those of white business owners.

- Black-owned loan applicant firms were half as likely as white-owned applicant firms to be fully approved for loans, lines of credit, and cash advances.

- The average loan to a POC-owned business is 39% smaller than the average loan to a white-owned business ($363K vs. $592K).

Similar imbalances can be seen across gender lines too:

- Female business owners account for less than 5% of all capital lent to small companies— despite the fact that women own 30% of small companies.

- Small businesses owned by women only receive 16% of all traditional small business loans.

- Female loan applications are more likely to be rejected, or have more stringent terms, than men.

Even access to local banks themselves is distributed unequally. A decades-long trend of closures and consolidation in the banking industry means that, today, the number of FDIC-insured banks is half what it was 20 years ago. While some major national banks have gone under, the majority of bank closures have befallen smaller, community banks; often in low-income communities. Today, 70% of minority-majority neighborhoods do not have a bank branch.

Instead, one in four small businesses applying for credit these days do so through an online lender; and Hispanic- and Black-owned businesses are more likely to use online lenders compared to their white counterparts. These online lenders, typically FinTech companies and Non-Depository Institutions, now comprise more than half of all small business lending in the US. While entrepreneurs certainly benefit from the ease of access to capital with online-first lenders, this trend also opens the door for more predatory pricing, as lenders can more easily reach entrepreneurs desperate for credit. Black and brown businesses are more likely to be considered higher credit risks by online lenders, and more than half of FinTech borrowers reported paying higher rates and a third reported unfavorable repayment terms. According to a Fed report online lenders have been observed levying interest rates as high as 70%, and they consistently rank the lowest in customer satisfaction of any lending type (18% satisfied).

The marketplace for equity capital, or venture capital (VC), is also highly concentrated and unevenly spread. Take its geographic distribution for example: 78% of all venture capital goes to just three states: New York, Massachusetts and California. The distribution of equity capital across racial and gender lines is equally appalling. In 2019, less than 3% of all VC investment went to women-led companies, and only one-fifth of US VC investment went to startups with at least one woman on the founding team. The average deal size for female-founded or female co-founded companies is less than half that of male-only-founded startups. And while VC investments to businesses led by Black entrepreneurs grew by more than four times in 2021, still only 1.4% of the record $329 billion in venture capital invested in US startups in that year went to firms with Black owners.

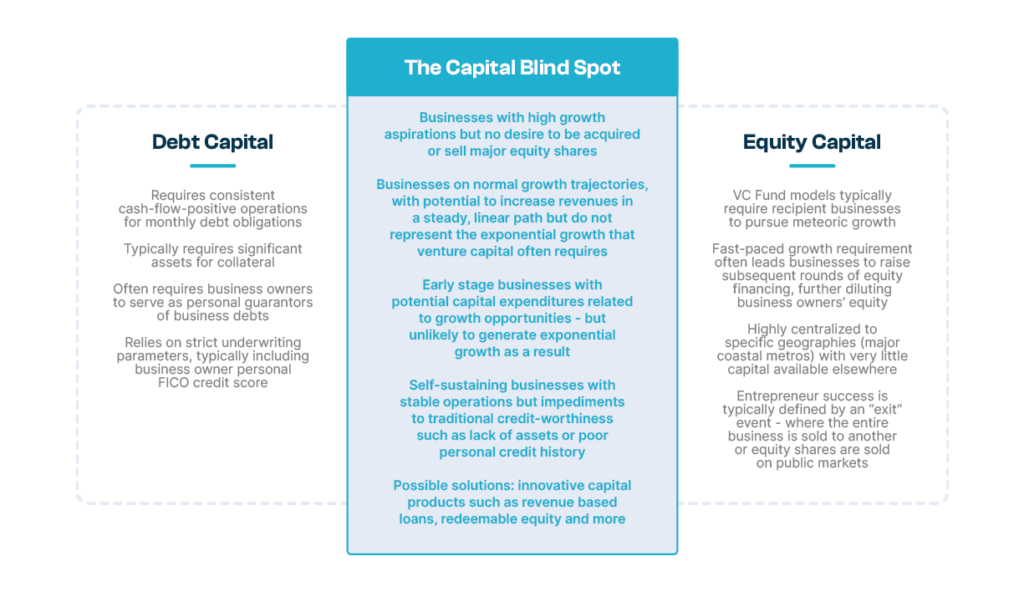

Problem #2: Debt and equity aren’t the only options for entrepreneurs, but the market of alternative products needs to grow.

It may seem unlikely that the vast array of small businesses could all fit neatly into one bucket or the other as perfect candidates for either debt or equity. In reality, many businesses contort themselves and their finances to fit one of the two predominant capital products available to them. These days, however, we’re seeing a growing trend of lenders and investors making changes to the structures of their capital products in order to meet the specific needs of entrepreneurs, instead of the other way around.

When compared to the traditional debt and equity capital products, these innovative financing models often have the ability to improve outcomes for both the capital provider and the entrepreneur.

The growth of these innovative capital products, and many more, demonstrate that entrepreneurial demand for capital extends far beyond the realms of traditional debt and equity. Not only do these capital products have the potential to fill gaps left unfilled by the status quo of small business finance, but they also may prove especially beneficial in bringing access to capital to the women and minority entrepreneurs who the debt and equity capital marketplaces have inadequately addressed.